Medicare Advantage Agent Near Me for Dummies

The Only Guide to Medicare Advantage Agent Near Me

Table of ContentsThe Best Strategy To Use For Medicare Advantage Agent Near MeThe Main Principles Of Medicare Advantage Agent Near Me Medicare Advantage Agent Near Me - Truths8 Simple Techniques For Medicare Advantage Agent Near MeAn Unbiased View of Medicare Advantage Agent Near Me

Based upon our analysis, the ordinary premium in 2020 for Medigap was $1,660, implying a representative would certainly be paid $322 for the first year as well as $166 as a renewal compensation. Due to the fact that premiums and price changes for policies can vary, commissions might move based upon recipient, policy, as well as area. Insurance firms likewise may make extra settlements, along with enrollment compensations.These tasks may include advertising and marketing, technology, training, and conformity; the companies offer as an intermediary between agents and also insurance companies. These repayments offer an additional network of economic support in between insurers as well as agencies and also agents.

Excitement About Medicare Advantage Agent Near Me

As an example, MA and Component D plans are measured with the celebrity rankings program and also are compensated in a different way for supplying a premium member experience. Pay-for-performance can be considered component of the payment model for representatives and firms. And 4th, the renewalcommissions design is a double-edged sword. Ensuring payments also if recipients stay with their initial plans may assist stop unneeded changing.

Policymakers could consider defining a minimal level of service needed to earn the renewal or switching payment. Representatives are an essential source for recipients, but we must reimagine settlement to make certain that rewards are extra closely lined up with the goals of giving advice and also advice to recipients and also without the threat of completing monetary passions.

The Buzz on Medicare Advantage Agent Near Me

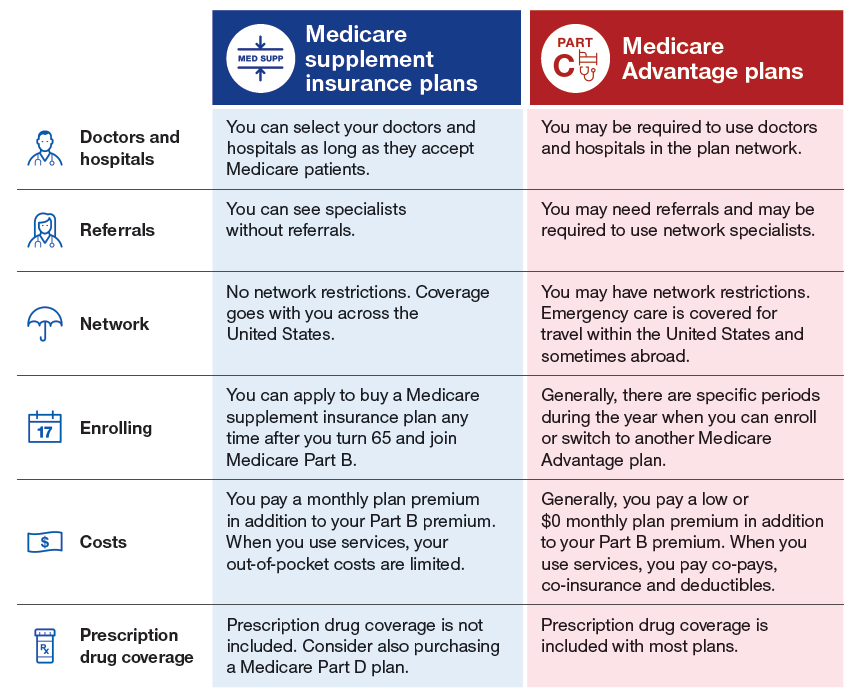

It's typical for people looking for a brand-new health insurance policy strategy to experience an insurance coverage agent, but is this essential when it comes to Medicare? The situation will certainly differ depending upon the kind of Medicare you want (Medicare Advantage Agent near me). If you do pick to opt for an agent, the information can still make the procedure vary extensively.

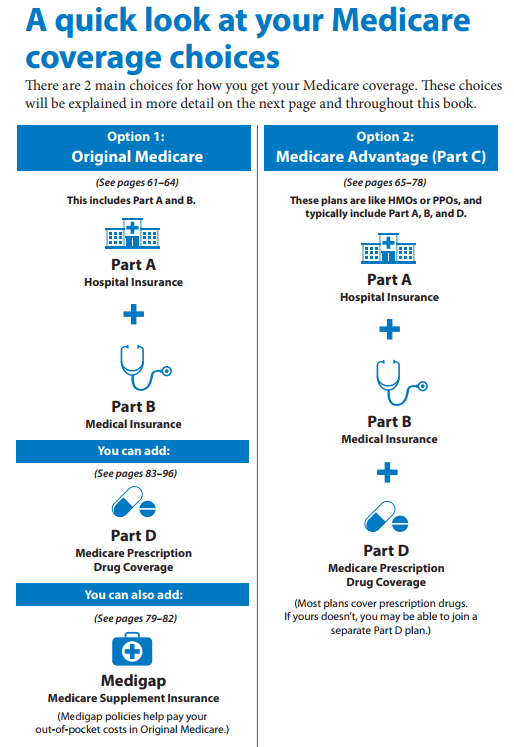

If you're just planning to sign up in Original Medicare (Medicare Parts An as well as B), then you will not require to utilize an insurance coverage agent. You won't be able to utilize an insurance coverage representative-- this type of Medicare is only available from the federal government. Insurance coverage agents will never ever enter the photo - Medicare Advantage Agent near me.

This is because Component D plans are offered by exclusive insurance provider. Medicare Advantage is by far one of the most common kind of Medicare insurance policy that is sold through insurance coverage representatives. Medicare Advantage prepares, also called Part C strategies, are generally a method of getting your health care protection with an exclusive strategy.

Medicare Advantage Agent Near Me Things To Know Before You Buy

Some Component C intends included prescription medicine plans packed with them, and some do not. If your own does not featured a PDP, then it can be possible to get Part C from one business and Component D from one more, while dealing with 2 different representatives for every plan. Medicare Supplement prepares, also called Medigap plans, are strategies that cover out-of-pocket prices anchor under Medicare.

These check my site strategies are likewise marketed by personal insurance coverage companies, which means that insurance representatives will have the ability to market them to you. When it concerns Medicare insurance policy agents, there are normally two types: captive and independent. Both can be licensed to offer Medicare. Although "captive" has a very adverse undertone, it is just used to describe representatives that benefit just one business, as opposed to agents that can deal with a selection of insurance coverage business.

The basic means that you can believe of captive versus independent representatives is that captive representatives are sales agents who are gotten to offer a certain insurance coverage product. Independent agents, on the other hand, are extra like insurance coverage brokers, meaning that they can offer you any kind of insurance item, as well as aren't limited to one company.

Unknown Facts About Medicare Advantage Agent Near Me

As you can think of, there is a much greater level of liberty that includes dealing with an independent insurance coverage agent as opposed to a restricted one. Independent agents can take a look at all of the insurance products they have accessibility to and also look for the one that works finest for you, while captive agents can just offer you one certain point, which may not be a good fit.

Independent representatives can just locate an additional strategy that fits your needs much better. An individual may have already done their research study and also understands which intend they desire and which cost they desire to pay.